Taxpayer Savings

35%

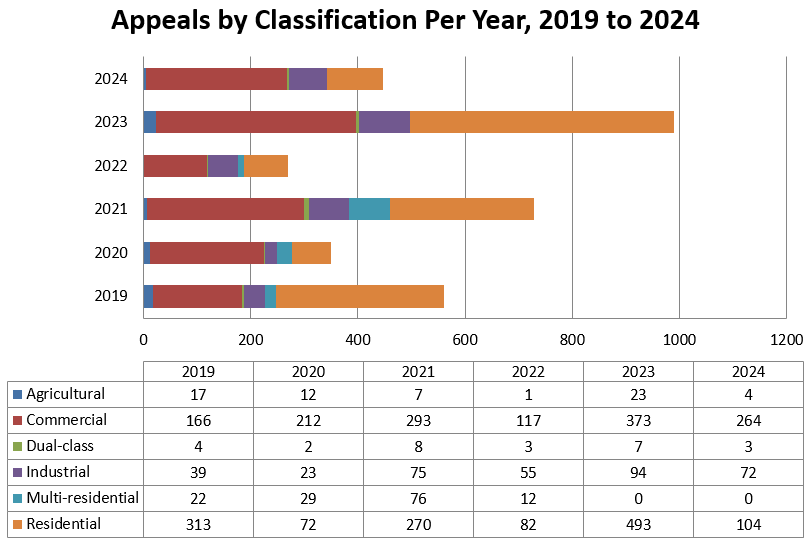

For the 2019 to 2023 appeal years, roughly 35% of PAAB appeals resulted in assessment reductions.

$26M

From 2019 to 2023, PAAB appeals resulted in an estimated $26 million in single-year tax savings for taxpayers.

2024 Appeal Data

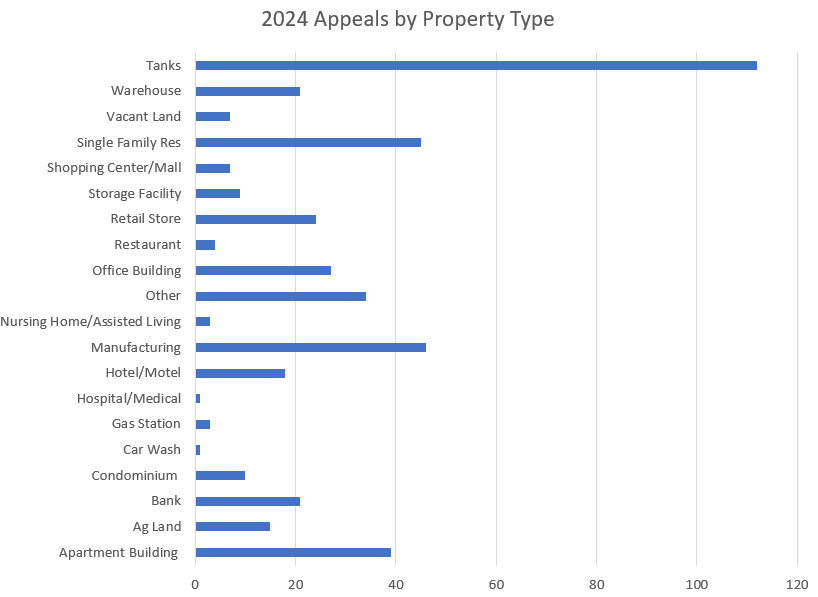

PAAB received 447 appeals in 2024. More than half were of commercial classified property. This is a relatively significant increase in appeals from prior interim years.

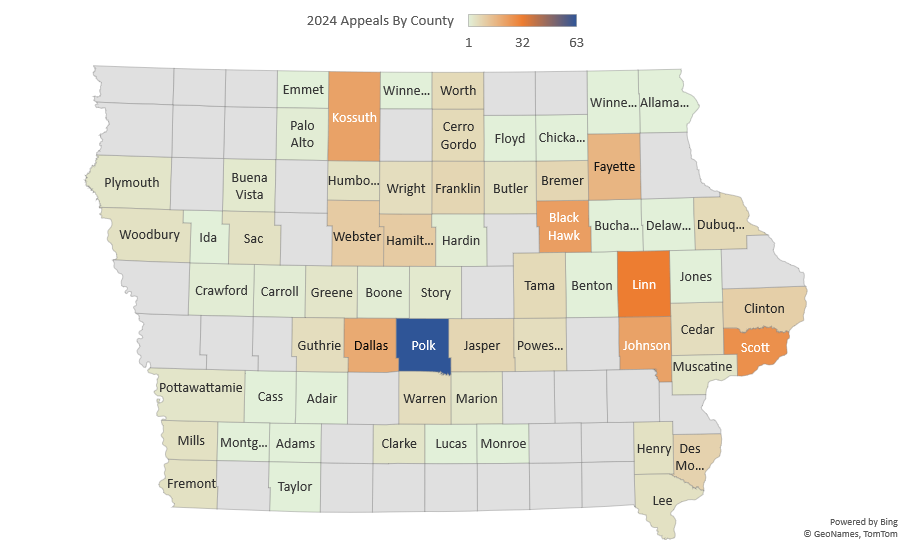

PAAB received appeals from 69 of Iowa's 106 assessing jurisdictions. The map below shows the general dispersion of PAAB appeals. Counties in gray represent counties where no PAAB appeal was filed.

A significant number of PAAB's 2024 appeals challenge the taxability of storage tanks.

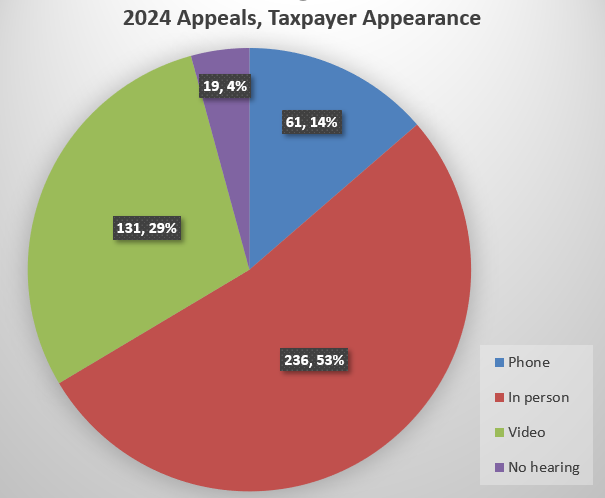

For the 2024 appeals, 96% of taxpayers requested hearings. As shown in the graph below, most taxpayers indicated a desire to appear at their appeal hearing in person.

In calendar year 2024, PAAB held 135 hearings or written considerations on appeals. Some hearings involved multiple appeals or parcels. This year, PAAB also issued 151 final orders following hearings or written considerations.

A large number of appeals are settled and never reach a hearing or written consideration. Some appeals are withdrawn. PAAB issues final orders on all of these appeals as well.

2023 Appeal Data

PAAB received over 1000 appeals in 2023.

PAAB received 990 appeals during the regular appeal period – a 35% increase from 2021. This is the highest level since PAAB changed its appeal docketing system in 2015.

A small number of appeals were also received during the fall equalization appeal period.

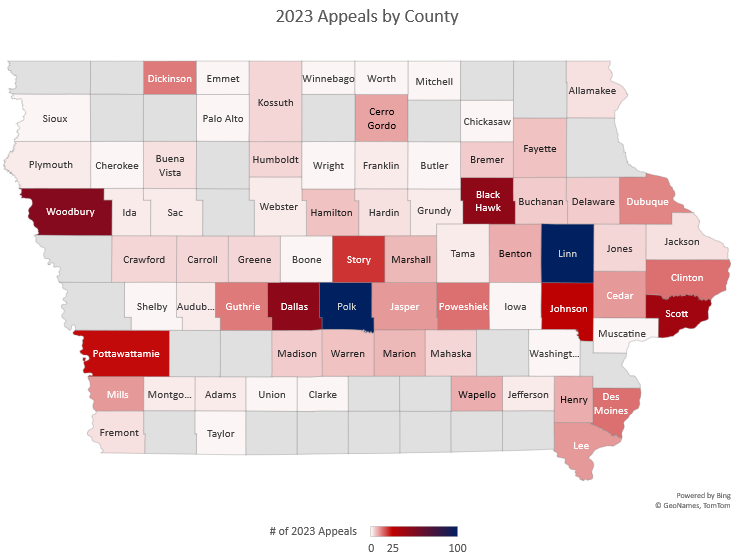

PAAB received appeals from 80 of the state’s 106 assessing jurisdictions. The map below shows the general dispersion of PAAB appeals. Counties in gray represent counties where no PAAB appeal was filed.

Polk County consistently leads in the number of appeals per year. In 2023, PAAB received 277 appeals from Polk County; nearly 28% of the appeals filed.

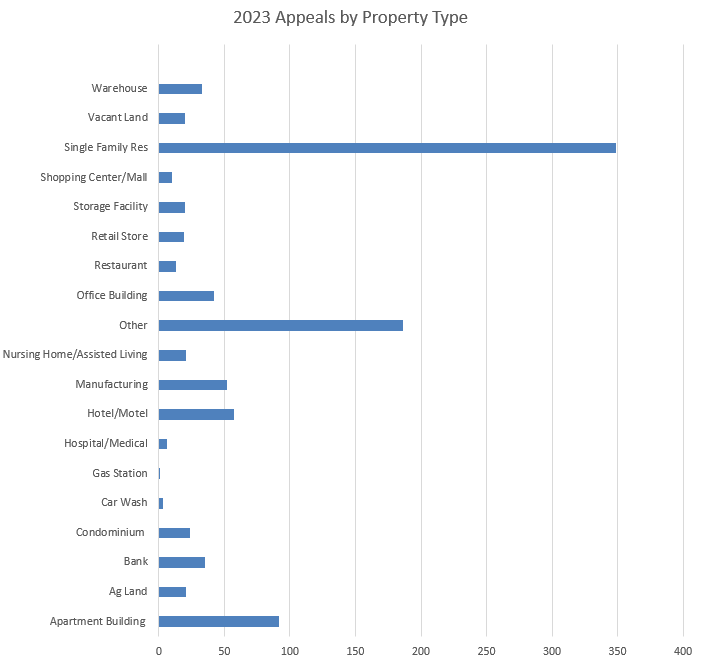

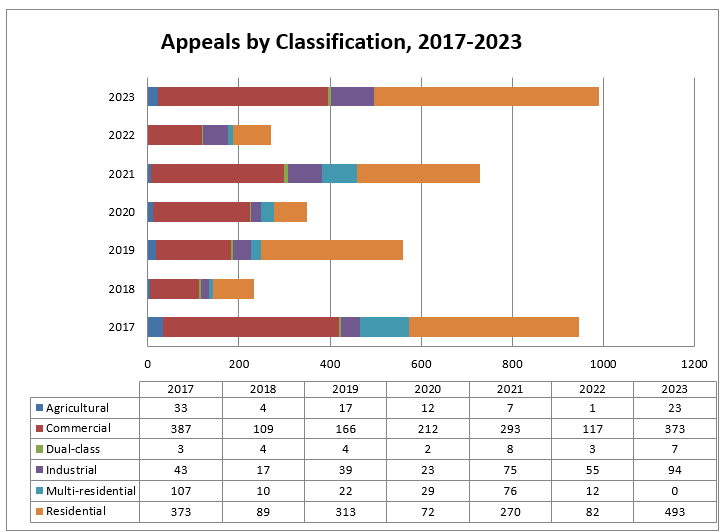

Single-family residential appeals are the single largest property type appealed. But they represented less than half of the total 2023 appeals.